Queensland Investment Corporation (QIC) is spearheading efforts to acquire AGL Energy’s 20% stake in Tilt Renewables, valued at approximately $500 million. This move underscores a broader trend of institutional investors consolidating their positions in Australia’s renewable energy sector.

Analysis:

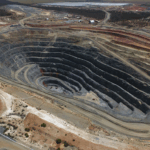

Tilt Renewables, a significant player in Australia’s renewable energy landscape, operates 1.9 GW of capacity across wind, solar, and storage assets, with a notable development pipeline including the 1.3 GW Liverpool Range Wind Farm. The company’s strategic focus on expanding its renewable energy portfolio aligns with the growing demand for sustainable infrastructure investments.

AGL Energy’s decision to divest its stake in Tilt Renewables reflects a shift in its investment priorities, emphasizing affordable energy for retail customers over growth in renewable energy assets. In contrast, institutional investors like QIC and the Future Fund are actively seeking opportunities in the renewable energy sector, driven by long-term growth prospects and alignment with sustainability goals.

The proposed acquisition is structured through a capital raise, with Aware Super, an existing investor in Tilt Renewables via a QIC fund, identified as a potential key contributor. This collaborative approach highlights the increasing role of institutional investors in shaping the future of Australia’s renewable energy infrastructure.

Investment Insight:

The Tilt Renewables transaction presents a compelling opportunity for institutional investors seeking exposure to Australia’s burgeoning renewable energy sector. The company’s robust asset base and strategic development pipeline position it well for sustained growth. However, potential investors should consider regulatory approvals and integration risks associated with the acquisition.

Australian Perspective:

This transaction reflects a significant shift in Australia’s energy landscape, with institutional investors playing a pivotal role in the transition towards renewable energy. The consolidation of renewable energy assets by entities like QIC and the Future Fund signals a strategic alignment with national sustainability objectives and offers potential avenues for long-term investment returns.

Global Context:

Globally, the trend of institutional investment in renewable energy infrastructure is gaining momentum, driven by increasing demand for sustainable investment options and supportive regulatory frameworks. This global shift is influencing investment strategies and capital allocation decisions across various markets, including Australia.